Sample: Panel-Data-Analysis-PDA-Mixed_Model_Rejting-Beta.pdf

Sample: Panel-Data-Analysis-PDA-Mixed_Model_Rejting-Beta.pdf

Uputa: Panel Data Analysis - SPSS Setting Up Mixed Model with No Predictors using Singer Data.pdf

Crveni tekst su komentari i informacije / Crni tekst ide u rad

Boju skinite, to Vam je samo za orijentaciju odakle je što.

za Rejting i Beta

No Predictors in the Model iz fajla:xxxxxxxxxxx-PDA-Moodys_Beta-2kG1107-No_Predictors.xlsx

.....

Centered Beta as a Fixed and Random Effect in the Model

iz fajla Jelena-PDA-Moodys_Beta-2kG1107--Fixed-Random.xlsx

|

Model Dimensiona |

|||||

|

|

Number of Levels |

Covariance Structure |

Number of Parameters |

Subject Variables |

|

|

Fixed Effects |

Intercept |

1 |

|

1 |

|

|

Beta |

1 |

|

1 |

|

|

|

Random Effects |

Intercept + Betab |

2 |

Variance Components |

2 |

Company |

|

Residual |

|

|

1 |

|

|

|

Total |

4 |

|

5 |

|

|

|

a. Dependent Variable: Moodys - Credit Ratings. |

|||||

|

b. As of version 11.5, the syntax rules for the RANDOM subcommand have changed. Your command syntax may yield results that differ from those produced by prior versions. If you are using version 11 syntax, please consult the current syntax reference guide for more information. |

|||||

|

Information Criteriaa |

|

|

-2 Restricted Log Likelihood |

51551,701 |

|

Akaike's Information Criterion (AIC) |

51557,701 |

|

Hurvich and Tsai's Criterion (AICC) |

51557,702 |

|

Bozdogan's Criterion (CAIC) |

51583,400 |

|

Schwarz's Bayesian Criterion (BIC) |

51580,400 |

|

The information criteria are displayed in smaller-is-better forms. |

|

|

a. Dependent Variable: Moodys - Credit Ratings. |

|

|

Estimates of Fixed Effectsa |

|||||||

|

Parameter |

Estimate |

Std. Error |

df |

t |

Sig. |

95% Confidence Interval |

|

|

Lower Bound |

Upper Bound |

||||||

|

Intercept |

,690738 |

,126857 |

84,003 |

5,445 |

,000 |

,438470 |

,943006 |

|

Beta |

,002767 |

,001623 |

220,783 |

1,705 |

,090 |

-,000432 |

,005965 |

|

a. Dependent Variable: Moodys - Credit Ratings. |

|||||||

Znači imamo statističku značajnost (Sig)

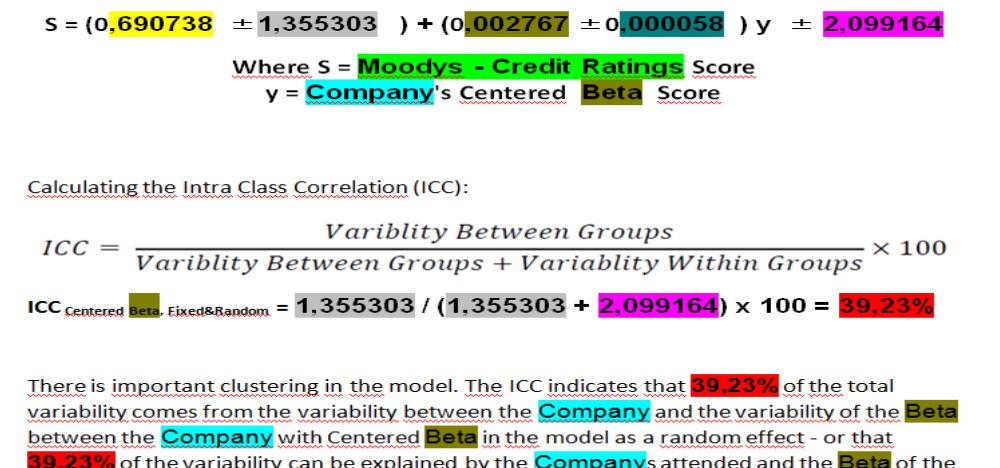

The intercept estimate of 0,690738 is the mean of the Moodys - Credit Ratings at the Company level. The Centered Beta estimate of 0,002767 is the slope (rate of change) of the line. It states that for every one point increase in Centered Beta an increase of 0,002767 in Moodys - Credit Ratings will be attained for that student. This is statistically identical to the Centered Beta estimate in the model with Centered Beta as only a fixed effect.

A formula for all this states simply:

S = 0,690738 + 0,002767 y

Where S = Moodys - Credit Ratings Score

y = Company's Centered Beta Score

|

Estimates of Covariance Parametersa |

|||||

|

Parameter |

Estimate |

Std. Error |

|

||

|

|

|||||

|

Residual |

2,099164 |

,024937 |

|

||

|

Intercept [subject = Company] |

Variance |

1,355303 |

,211064 |

|

|

|

Beta [subject = Company] |

Variance |

,000058 |

,000017 |

|

|

|

a. Dependent Variable: Moodys - Credit Ratings. |

|||||

The residual estimate of 2,099164 is the variability within Companys. The intercept estimate of 1,355303 is the variability of the intercept between Companys and the Beta estimate of 0,000058 is the variability of the Beta between Companys. Thus, the total variability between Companys is 1,355361 (1,355303 + 0,000058).

The residual estimate of 2,099164 is the information that cannot be explained within Companys. It also can be added or subtracted to the equation above to indicate the variability in that equation. The intercept estimate of 1,355303 indicates the variability in the intercept estimate and can be added or subtracted to the intercept estimate above to show the variability. The Beta estimate of 0,000058 indicates the variability in the Beta estimate and can be added or subtracted to the Beta estimate (slope) above to show the variability. (When Centered Beta is a random effect and because it is continuous variable, it gives variability to the slope of the equation, not the intercept.)

Thus:

S = (0,690738 61,355303 ) + (0,002767 60,000058 ) y 6 2,099164

Where S = Moodys - Credit Ratings Score

y = Company's Centered Beta Score

Calculating the Intra Class Correlation (ICC):

ICC Centered Beta, Fixed&Random = 1,355303 / (1,355303 + 2,099164) x 100 = 39,23%

There is important clustering in the model. The ICC indicates that 39,23% of the total variability comes from the variability between the Company and the variability of the Beta between the Company with Centered Beta in the model as a random effect - or that 39,23% of the variability can be explained by the Companys attended and the Beta of the Company. This explains less of the clustering as compared to when Centered Beta was treated as a fixed factor: 38,96%